As previously mentioned, World Builder isn’t a single project. It’s an ecosystem. It’s a think tank and incubator that will launch several projects, and help other people launch their own projects as well. To create a more unified system, and to create a number of interesting economic dynamics, we’re creating a token forging system.

Most token based projects release tokens as part of an ICO. However, this system is really just a security sale. And tokens that aren’t representative of actual ownership really shouldn’t be securities related to the operation. So we’re promoting a different route.

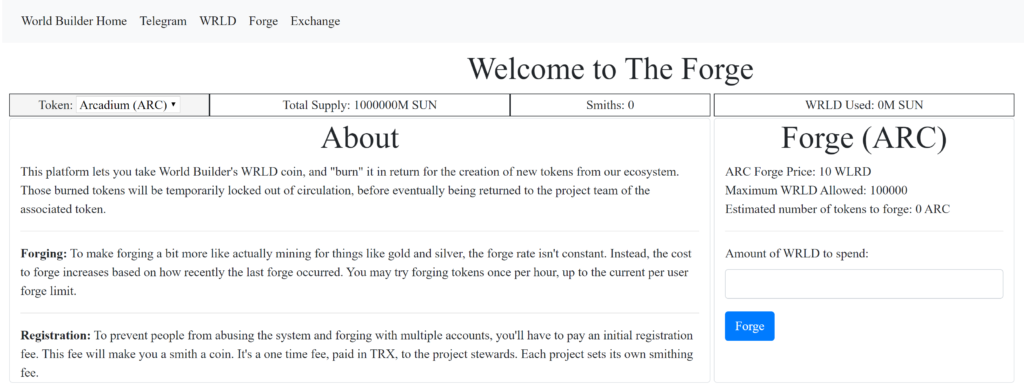

Using WRLD, people will be able to forge new tokens for related projects. The amount of WRLD needed to forge a new token will depend on a number of factors, established by the project developers. However, a number of aspects will be universal to each project. First, a TRX fee will be needed in order to become a smith for a given token. The second is that as more people try to forge tokens, the cost to forge will increase, and only decrease as time passes. This process in some ways simulates limited resource capacity in mining and other similar tasks, and creates a PVP environment.

Moreover, the WRLD that’s given to the project will not be distributed immediately. It will be locked out of circulation. The exact rate at which a project will be able to reclaim the tokens will be set by the team, but will generally be about 1% per month. In this way, the total amount of WRLD in circulation will decline as more people forge tokens and more projects emerge. As a result, there will be a constant fluctuation in available tokens, creating a more dynamic ecosystem for WRLD.

Example Forging

Here’s a very simple example of how the forging system will work, using the Arcadium token as an example. You can learn more about Arcadium by visiting its official Telegram channel.

There’s still a lot of work to do, and we’ll be beta testing the system for a while. However, as the project grows, we’ll release more details and open the process up to additional members.

Make sure to bookmark the World Builder site, and if you want to start collecting WRLD, just grab some from the faucet.